Apply Sales Tax and Service Fees

In this article, learn how to apply a sales tax and service fees to clients at checkout.

APPLIES TO: Admins

Last updated: December 20, 2023

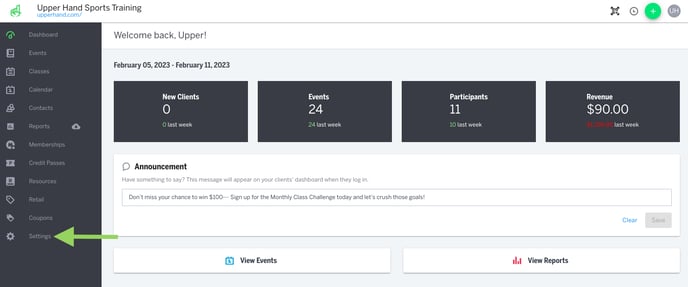

To access your accounting codes and service fees, log into your account and hover over the main navigation bar on the left and click on Settings, then click on the Accounting tab.

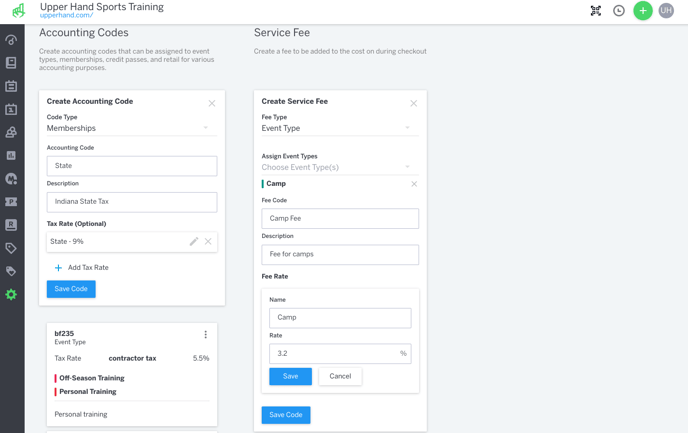

Create Accounting Code

- Click + Create Accounting Code

- Choose a Code Type

- Note: You will have to create a new code for each code type

- Enter an Accounting Code

- Note: This is for internal use only and will not be visible to clients

- Enter a Description

- Note: This is for internal use only

- Create a Tax Rate

- Enter a Name

- Enter the percentage you want to be applied at checkout

- Select Save

- Click Save Code

Tip: If you are unsure what sales tax requirements exist in your state, you can visit this webpage for a helpful guide.

Create Service Fee

- Click Create Service Fee

-

Select Fee Type

-

Note: this is the product that you want the fee to apply to during checkout

-

-

Enter Fee Code

-

Note: this is for internal use only and can be named anything

-

-

Enter Description

-

Note: this is for internal use only

-

-

Create Fee Rate

-

Enter a Fee Name

-

Enter in Percentage you want charged during checkout

-

Note: Legally this cannot be higher than 4%

-

-

Select Save

- Click Save Code

To further your understanding of this feature, be sure to check out the course: 03. Upper Hand Account Setup inside Upper Hand University.